Remember the episode of The Office where Michael trusted the GPS navigation system in his car so completely that he drove into a lake?

Remember the episode of The Office where Michael trusted the GPS navigation system in his car so completely that he drove into a lake?

Michael: May I have your attention please. This office will not be using any new technology ever.

Ryan: That is not correct.

Michael: Ryan thinks technology is the answer, well guess what, I just drove into a lake.

Oscar: Into what?

Michael: I drove my car into a ****ing lake!

Michael: Why, you may ask, did I do this? Well, because of a machine. A machine told me to drive into a lake and I did it. I did it because I trusted Ryan’s precious technology and look where it got me.

Jim: In a lake.

Michael: Exactly.

At first blush, the idea of this actually happening sounds absurd. But, sadly, this is a case of truth being every bit as strange as fiction. A few minutes of surfing the internet turns up the following:

- AFP: Polish driver follows GPS directions into lake

- GPS leads driver into tight spot, stays wedged for three days

- Man follows GPS directions onto train tracks, into dummy hall of fame

- Motorist has faith in GPS, drives into a sandpile

- Faith in GPS sends Mercedes downstream

- GPS sends another driver onto train tracks of doom

- Driver nearly got killed following GPS instruction

- Driver blames GPS for his car’s collision with train

There are a lot more, each one seemingly dumber than the one before. Fortunately, most of us have enough common sense to refrain from trusting a computer over what our own eyes tell us. But what about those less obvious circumstances?

In the last couple of years we have seen some of the largest financial institutions on earth wreck themselves beyond repair due to blind faith in complex risk modeling applications. As individuals, we often place the same kind of faith in retirement planning software that tells us, based on a “reasonable” assumption of future returns, how much we need to save every month to reach our goal. Or maybe we reduce uncertainty even further by putting our retirement plan through a Monte Carlo simulation that will determine the probability of success. These tools are employed by literally millions of people and nearly all of the largest, most sophisticated financial companies you can think of. That kind of wide acceptance should be reassuring, right?

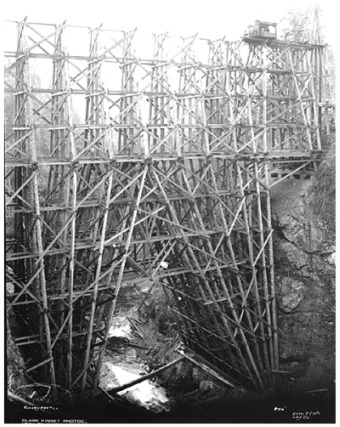

As a kid, I was always fascinated by the pictures of the gigantic train trestles the old timber companies built to connect their supply of logs to their sawmills.

Clearly there was some engineering sophistication that went into these structures, but how did they know that they would hold up to the millions of tons of train & logs over many years of use, in the heat of summer and icy cold of winter without collapsing? They didn’t have the benefit of computer simulations that could calculate the effects of weight, wind, ground heave, changing humidity, wild swings in temperature, seismic activity, etc. My guess is that the train crews forced the engineer that designed the trestle to make the first crossing.

Clearly there was some engineering sophistication that went into these structures, but how did they know that they would hold up to the millions of tons of train & logs over many years of use, in the heat of summer and icy cold of winter without collapsing? They didn’t have the benefit of computer simulations that could calculate the effects of weight, wind, ground heave, changing humidity, wild swings in temperature, seismic activity, etc. My guess is that the train crews forced the engineer that designed the trestle to make the first crossing.

If you were in charge, and your life was on the line, would you err on the side of overbuilding or saving on the cost of construction?

I’m going to say overbuilding. From the standpoint of the timber company, overpaying for construction is a less frightening prospect than a collapsed trestle and a full load of logs, train & crew at the bottom of a river canyon.

I’m going to say overbuilding. From the standpoint of the timber company, overpaying for construction is a less frightening prospect than a collapsed trestle and a full load of logs, train & crew at the bottom of a river canyon.

Now think about these retirement simulators. They generally ask you to make an assumption about the rate of return you expect to get from your investments over a long period of time. What if you guess wrong? What if, instead of 6% or 7% or 8%, you end up getting 2%? Will your retirement standard of living end up a smoldering, broken heap in the bottom of a canyon?

One of the unintended consequences of relying on modern planning tools is that we sometimes trust the technology too much and don’t leave ourselves room for error. We save or withdraw the amount the software tells us to or we base return assumptions on suggestions offered by the tool. If we run a Monte Carlo simulation and learn, based on our current asset base and rate of monthly savings, that we have a 90% probability of reaching our goal, we wouldn’t feel much urgency to change anything. But 90% probability is not the same as a sure thing. It leaves a 1 in 10 chance that our plan fails, and that’s assuming the Monte Carlo simulation is accurate – which is a huge assumption.

This is a good time to revisit those old assumptions and consider overbuilding, which in this circumstance means two things: saving aggressively and making better use of risk management tools to protect what we already have. Even if the machine isn’t telling us we need to do it.

Disclosure: Past performance is not indicative of future results. All indices are unmanaged and investors cannot invest directly into an index. Ideas and opinions expressed in this article are the sole responsibility of Patrick Crook/PLC Asset Management and do not reflect any stated opinions of Commonwealth Financial Network, National Financial Services LLC, Member NYSE/SIPC or any other person or entity.