In the movie Shallow Hal, the protagonist (Hal) has a hard time finding love due to his ridiculously superficial views toward women. A chance meeting with self-help guru Tony Robbins illustrates the depth of his problem: Continue reading

In the movie Shallow Hal, the protagonist (Hal) has a hard time finding love due to his ridiculously superficial views toward women. A chance meeting with self-help guru Tony Robbins illustrates the depth of his problem: Continue reading

Category Archives: psychology

Investing For Pain Avoidance

Pain is a great teacher. The threat of pain is a great motivator. Behavior in every aspect of human endeavor has been shaped by a desire to avoid pain: legal compliance, romantic relationships, political compromise, etc. It’s a basic, fundamental element of being human. Unfortunately it sometimes backfires.

Pain is a great teacher. The threat of pain is a great motivator. Behavior in every aspect of human endeavor has been shaped by a desire to avoid pain: legal compliance, romantic relationships, political compromise, etc. It’s a basic, fundamental element of being human. Unfortunately it sometimes backfires.

Let’s examine a few painful motivators for investors and how they are typically mismanaged: Continue reading

Three Ways To Ruin Your Edge

In The Pruning Effect we looked at actual results generated by a strategy designed to deliver a lopsided relationship between the size of gains relative to the size of losses. This asymmetry of returns results in a statistical advantage over time which is the key in separating investing from gambling.

In The Pruning Effect we looked at actual results generated by a strategy designed to deliver a lopsided relationship between the size of gains relative to the size of losses. This asymmetry of returns results in a statistical advantage over time which is the key in separating investing from gambling.

Possession of a statistical edge is a vitally important factor in sustaining performance over an investing life that can span many decades. Luck can help you out here and there, but luck is unreliable. A good plan is one with rules that can be measured and replicated. A good plan is a prerequisite for long term results but it is just that – a prerequisite. People with good plans fail all the time, not because of their plan, but because they are people that suffer from human nature. Here are three ways we traditionally blow our edge and sabotage a perfectly good plan: Continue reading

Why Do People Crave Predictions?

Investors looking to improve their decision making skills would do well to replace one (or all) of their financial news sources with Brian Burke’s advancednflstats.com. In a recent post, he writes:

Investors looking to improve their decision making skills would do well to replace one (or all) of their financial news sources with Brian Burke’s advancednflstats.com. In a recent post, he writes:

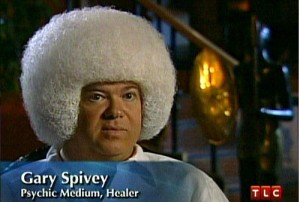

“I once wrote to our own Carson Cistulli in an email that “People love lists and they love predictions. What I give them is lists of predictions.” Frankly, it wouldn’t matter how accurate the predictions are. People just crave them. The future creates anxiety, and whether accurate or not, predictions, help relieve it. At least, that’s what my astrologer tells me.”

He’s right. People crave predictions regardless of whether or not they provide any actual benefit. Burke has a simple, quantitatively driven model for predicting the outcome of football games that just happens to actually provide a benefit. Continue reading

8 Ways I’ve Been Wrong In The Last 24 Hours

- Thought the Beavers would beat the Cougs last night.

- Overslept by four minutes this morning – I wake up at the exact same time every day, so it was a surprise.

- Thought my back had healed enough to pitch batting practice yesterday.

- Went to put my vehicle through the car wash this morning, but it was closed for, what looks like, major remodeling. I literally drive past it every day and didn’t notice until today.

- Every morning I make a decision to take one of two routes when leaving the parking lot after dropping my son off at school. Today’s route was backed up by traffic for much longer than the other route (which you can see while waiting).

- Emailed the wrong form to a client and then immediately resent the correct one after noting the error a nanosecond after clicking the send button.

- Took a sales call this morning even though I knew who was calling and knew it would be a waste of time. Not sure why I still do that sometimes.

- Switched cars with my wife about an hour ago and forgot to grab my wallet.

Obviously, the last 24 hours has been fairly uneventful. These mistakes are trivial, really not even worth noting. However, they leave a clue that points to a bigger problem. If all of us can make these kinds of common errors involving daily, routine occurrences, why should we expect decisions made on big, unfamiliar, infrequent things to be any more accurate?

For example, let’s say that you are planning for your retirement and you make an assumption that your money will earn x% for the next twenty years. What if you are wrong? Not just a little off, but spectacularly wrong? Or, let’s say you are absolutely convinced that the economy will do x and this will cause the market to do y. Could you be wrong? Could you be right about one part of it and still wrong about the other? Yes, of course you could.

We are regularly wrong about the biggest, most momentous decisions in life. The divorce rate is near 50%. Accidental pregnancies happen all the time. People are often swindled by longtime friends and even family members. We hire the wrong people. Borrow ungodly sums of money for college degrees of questionable value. The list is endless.

Humility is valuable. A decision, especially with regard to forecasting an investment or a market, should come with an explicit acknowledgement that you can’t know the future. You should expect to be wrong with a high degree of regularity. Since being wrong is unavoidable, we have to plan for ways to live with it. Plan for ways of limiting the damage of being wrong while maximizing the benefit of being right.