“Everything should be made as simple as possible, but no simpler.”

-Albert Einstein

We are midway through the first quarter of the year and in the thick of some real turmoil thanks to second and third order effects of falling oil prices and Greek elections. Just kidding! It only seems that way if you listen to commentators on CNBC or read the news. The real truth is, the current investment environment is a tale of simplicity.

As an investor, my two main priorities are to, 1) participate in growing markets and, 2) avoid disaster. If we can do that reliably we’re in pretty good shape. Simple, right?

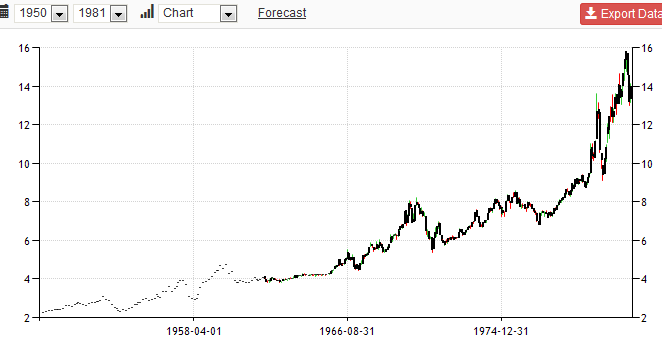

The first task in this pursuit is identifying growing markets. To that end, there are a couple of monster trends that have been in place for a long time that simplify this job. Exhibit one is the ongoing collapse in interest rates. The chart below shows the yield of the 10-Year US treasury bond from 1982 through the present.

I have been hearing predictions of rising rates literally every year of the more than two decades I have been in this business. Undoubtedly it will happen someday, but betting against a major trend is a tough way to make money.

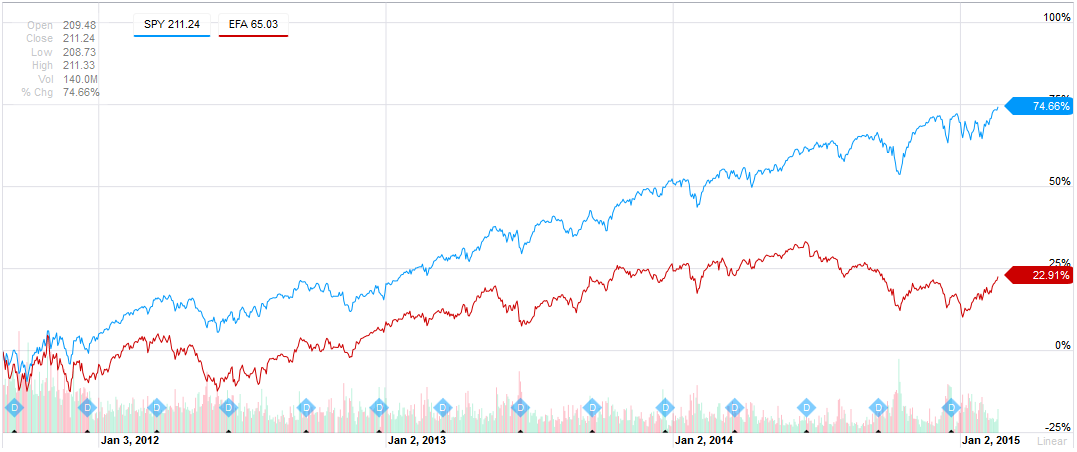

The second powerful trend is the dramatic outperformance of the US stock market relative to the rest of the world over the last three and a half years. This chart displays SPY (S&P 500 index etf) against EFA (Europe, Asia, Far-East index etf) since September of 2011, a period in which domestic stocks have more than tripled the gain of foreign stocks.

You’ve read myself and others remark on the historically high current valuation of domestic stocks, but price multiples are under no obligation to stay within prescribed limits. The reality of this environment is that valuations don’t matter nearly as much as other considerations. At least for now.

These two trends explain the current composition of our portfolios. Our holdings represent a combination of interest rate sensitive instruments and domestic stocks. At the same time, we are avoiding exposure to things like foreign stocks, commodities and low-duration, less interest rate sensitive bonds.

Identifying and participating in growing markets is pretty straightforward. Avoiding disaster is a bit trickier. I’ve written many thousands of words about managing downside risk so I won’t belabor the issue once again here, but there is an important related point.

The twin priorities listed above of participation in growing markets and disaster avoidance are just tactics in service of a larger objective. The most important characteristic in an investment plan is adaptability. Remember the famous quote from Charles Darwin, “It is not the strongest of the species that survives, nor the most intelligent, but the one most responsive to change.” In this way, investors are like species. To survive, you have to be responsive to change, because the one thing we know for sure about markets is that the environment eventually changes.

The first image above showed the relentless downward trend in treasury bond yields over the last three decades. Now look at the three decades immediately preceding:

Here’s the (obvious) point. An investment approach designed to work well in this environment would have produced a dramatically different result during the following thirty years of plummeting rates. To prosper, your timing doesn’t have to be perfect but you do have to bow to reality. Boom and bust cycles have been a regular occurrence for every asset class throughout recorded history. This is why it’s not enough to just pick a mix of assets and hold them in the same proportions forever. Being an adaptable investor means not just moving toward growth but also away from non-productive or even harmful exposure. It’s a simple concept, but not too simple.

For the sake of brevity I’ve left a lot out of this discussion. The type of securities we own, the frequency of decisions, the amount of diversification, the universe of choices, etc. all matter greatly and we’ll get into that a little more next time. For now, the main concept to bear in mind is that the concentrations within our portfolios are defined by the environment as it is, not as we think it should or might or could be, but as it is. This environment will change at some point and we will change with it. I don’t know when it will happen or what will cause the changes, but the intention to evolve and the process for doing it is already in place.

Enjoy this post? Interested in original investment ideas? Please subscribe now to be notified whenever a new article or free white paper is published.

Disclaimer: Investments are subject to risk, including the loss of principal. Some investments are not suitable for all investors. Talk to your financial advisor before making any investing decisions. Past performance is not indicative of future returns. Information displayed is taken from sources believed to be reliable but cannot be guaranteed. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. All indexes are unmanaged and investors cannot invest directly into an index. Unlike investments, indexes do not incur management fees, charges, or expenses. Past performance does not guarantee future results. Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved. Ideas and opinions expressed in this article are the sole responsibility of Patrick Crook/PLC Asset Management and do not reflect any stated opinions of Commonwealth Financial Network, National Financial Services LLC or any other person or entity.