It’s said that everyone has a double somewhere in the world. That seems unlikely, in the physical sense, but I bet most of us can imagine a professional doppelganger. A retired Italian physician. A French chemistry professor. An Irish engineer. Someone with a similar amount of money, living a similar lifestyle. Someone just like us in all respects except where they live. A real person that shares our same aspirations and fears.

One of the most common fears shared by people in or near retirement is the risk of outliving their money. This is the basic reason behind most saving and investing in the first place. People want to be protected from the vulnerability that comes along with being financially dependent on someone else. Unfortunately, the investment approach many people choose for their savings sometimes ends up creating the problem they were trying to avoid.

Conventional wisdom says that the smartest approach to managing your retirement assets is to plan out an appropriate mix of stocks and bonds and then occasionally rebalance your holdings when the mix gets a little out of whack. Don’t panic, don’t get greedy, just let the markets work for you over time. This is actually a pretty good way to go as long as the markets you invest in eventually produce gains within a reasonable time frame. But what if they don’t? This isn’t an abstract problem, it’s happening to millions of people around the world right now.

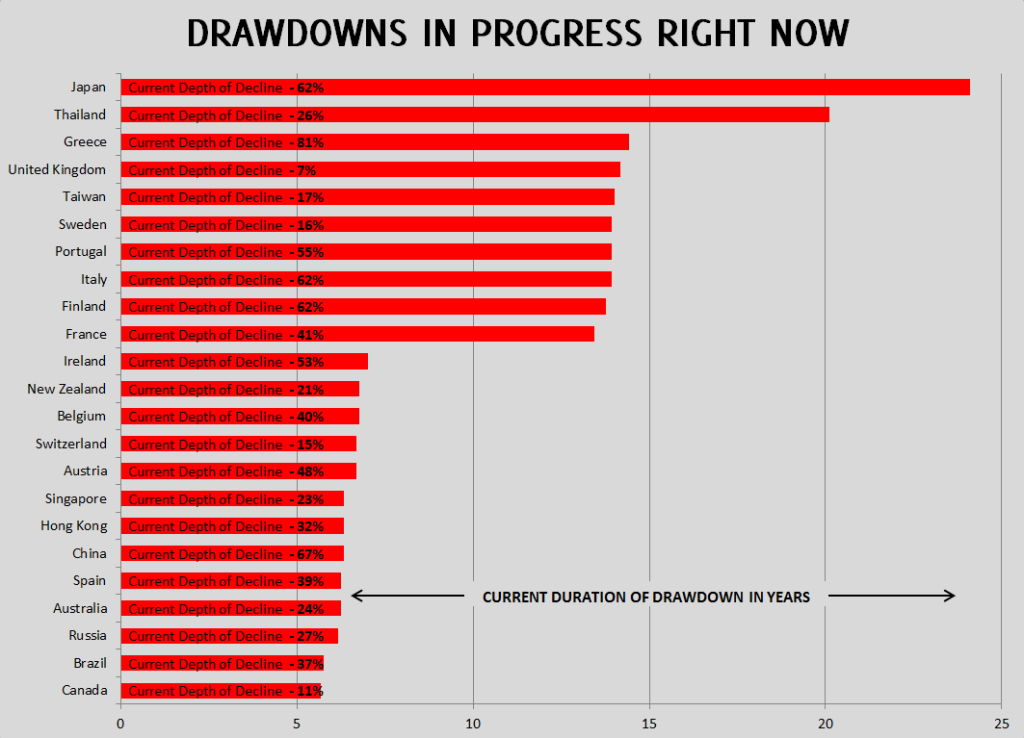

The chart below (click to enlarge) is a sampling of countries whose stock markets have yet to recover from a previous decline. In some cases they haven’t bounced back from the 2007-08 selloff. In other cases they are still trying to come back from a plunge that started in 1999. In a couple of cases, they are mired in a drawdown that has lasted for more than twenty years.

It would be human nature for us to dismiss these examples, but that would be a dangerous indulgence. Collectively, these countries have a population of 2.279 billion people. Seven of the world’s ten largest economies are in this chart. Some of them have a lower rate of unemployment than we do. Some have a stronger balance sheet. A sounder currency. There are modern economies and emerging economies represented here. There is no reason to think we have some type of immunity from a similar outcome and, in fact, we have seen similar periods here in the past.

The point of this post isn’t to rehash past declines or issue a dire warning of something bad looming in the near future. It’s a reminder that time can start to work against you very quickly in retirement. It doesn’t take much effort to imagine ourselves in the shoes of an Italian or French or Irish counterpart. Retirement savings split between stocks that are still down more than 60% from where they were fourteen years ago, combined with low bond yields make the spectre of depleted savings a reality. This is a lesson you don’t want to learn the hard way.

Here are three things you can do to protect yourself:

- Diversify your risk and your opportunity. It’s easy and inexpensive to invest across a wide array of countries and currencies and asset classes. Being dependent on one market makes you vulnerable to forces outside your control.

- Have a plan to help protect your downside. Investors often lose sight of the real job. It’s not to pick the best stock or predict what the Fed is going to do. Your real job has two components: provide an avenue for growth and avoid disaster. That’s it. Most investors put a lot of time into the first part, but leave the second part to faith that the market will always come back as long as they’re patient. Your Italian lookalike would like to have a word with you about that.

- Watch your spending. Large fixed obligations, especially debt, restrict flexibility and can force you into a death spiral of consuming principal beyond your ability to recover.

If you don’t have a plan that addresses both the growth and the protection of your retirement savings, it’s not too late. Give us a call and we can help.

Related posts:

Enjoy this post? Interested in original investment ideas? Please subscribe now to be notified whenever a new article or free white paper is published.

Disclaimer: Past performance is not indicative of future returns. Information displayed is taken from sources believed to be reliable but cannot be guaranteed. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. All indices are unmanaged and investors cannot invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results . Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved . Ideas and opinions expressed in this article are the sole responsibility of Patrick Crook/PLC Asset Management and do not reflect any stated opinions of Commonwealth Financial Network, National Financial Services LLC or any other person or entity.