The first part of this series was about how learning to “love the loss” could provide protection, put us in front of more opportunities, unlock time and help make us more objective thinkers. The indirect strategy of gaining by losing can be extremely effective when done right. This part of the series addresses the corollary to loving the loss – hating the win.

The first part of this series was about how learning to “love the loss” could provide protection, put us in front of more opportunities, unlock time and help make us more objective thinkers. The indirect strategy of gaining by losing can be extremely effective when done right. This part of the series addresses the corollary to loving the loss – hating the win.

This isn’t just an attempt at hyperbole, hating the win is as important as loving the loss. The reason for this is rooted in our psyche. When it comes to spur-of-the-moment financial decisions, our instincts are terrible. This was demonstrated brilliantly in 1979 by Kahneman & Tversky in a paper titled Prospect Theory: An Analysis of Decision under Risk. The paper reports the findings of a study of how and why we make decisions under the threat of loss. It’s worth reading yourself, but a simplistic summary would be – “we hate losses.” We hate a loss a lot more than we love an equally sized gain.

This asymmetry in emotion often causes us to make irrational decisions. For starters, it can lead us to avoid taking a loss when we should. We want to deny its very existence. We want to ignore the loss and hope it just goes away by itself. We rationalize it and make excuses for it. This is why we have to learn to love losses. It doesn’t come naturally.

What does come naturally is loving the win. We don’t love it as much as we hate the loss, but we do love it. We love it so much, we can’t bear the thought of letting it get away. At the first sign of trouble we want to capture the win so it’s ours forever.

Our brains care more about wins vs. losses than gains vs. losses. This is a crucial distinction. The poisonous combination of loving wins and avoiding losses can lead to gains being capped early and small while losses are left to grow and become large – precisely the opposite of what should happen. Hating the win doesn’t mean we don’t want gains – quite the opposite – it means we want meaningful gains. The way to get those is by accepting the risk of letting a small win turn into a small loss.

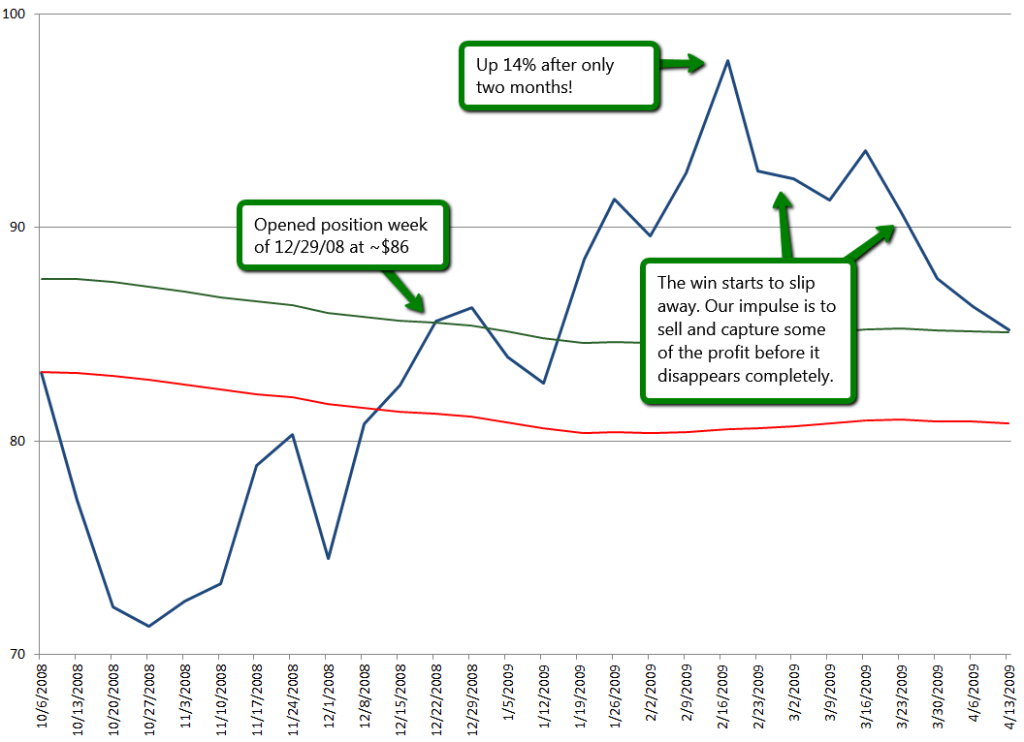

Take the following example:

The chart above shows a position that was bought at the end of December 2008. An early upward surge reversed course quickly and threatened a loss. When this happens, our instinctive reflex is to grab it before it evaporates forever. However, by learning to hate the (small) win and love the (small) loss, we put ourselves in a position to perform rationally – cut losers short and let winners run.

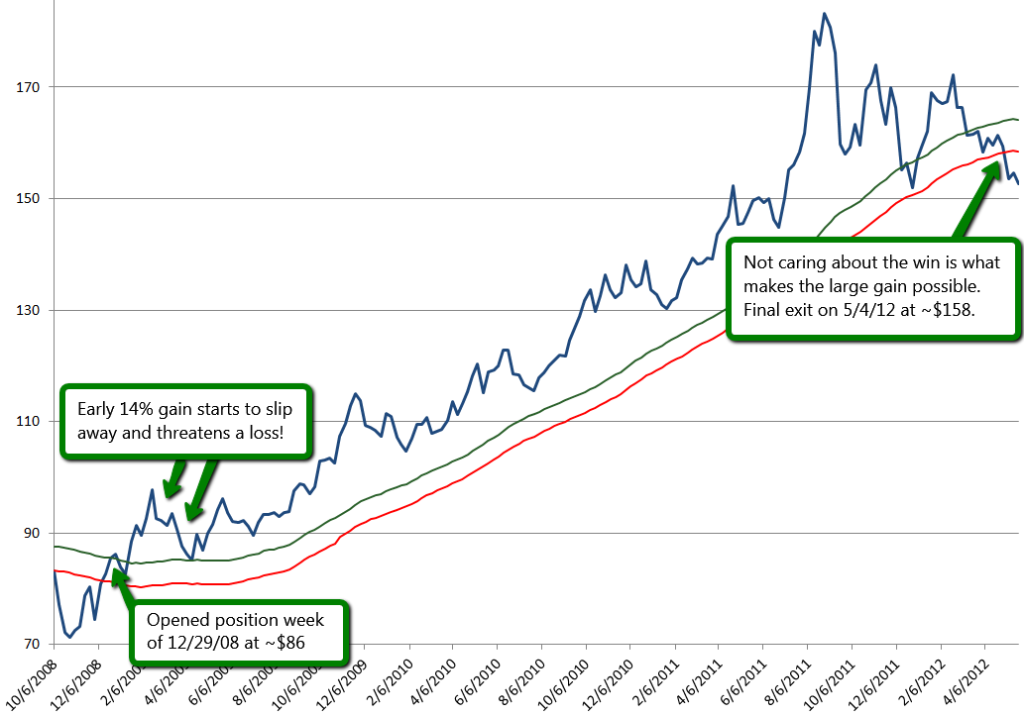

Here’s how this one ultimately played out:

In this case, hating the win paid off. We had to be willing to let it go to get something better.

Main point: Most positions don’t work out as well as this example, which is exactly why it’s so important. The really valuable, impactful gains are much less common than the average result. Since they don’t come along every day, the risk of prematurely jettisoning of one of these positions presents more danger than that of taking an inconsequential loss.

This concept is simple, but not easy. The indirect, strategic route can feel alien for a very long time. Thousands of generations of human evolution is not conquered over the life-cycle of a few investments.

Related Posts:

Enjoy this post? Please subscribe now to be notified whenever a new article or free white paper is published.

Disclaimer: Past performance is not indicative of future returns. Information displayed is taken from sources believed to be reliable but cannot be guaranteed. All indices are unmanaged and investors cannot invest directly into an index. Ideas and opinions expressed in this article are the sole responsibility of Patrick Crook/PLC Asset Management and do not reflect any stated opinions of Commonwealth Financial Network, National Financial Services LLC or any other person or entity.