Aesop was the author of the most tortured parable in the history of finance. Everyone knows that you’re supposed to bet on the tortoise over the hare. Slow and steady wins the race. It’s a winning message. Everyone likes the idea of steady returns. Steady feels solid.

Aesop was the author of the most tortured parable in the history of finance. Everyone knows that you’re supposed to bet on the tortoise over the hare. Slow and steady wins the race. It’s a winning message. Everyone likes the idea of steady returns. Steady feels solid.

The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.

-Jesse Livermore

Steady would be fine but, when it comes to the capital markets, it’s unrealistic. Investment markets are never permanently steady. They can be intermittently steady though. We’re coming off of a couple of years of steady stock market returns and it is comforting. Comforting enough that a lot of people have forgotten what precipitated this period of stability – a collapse severe enough to prompt fears that the whole system would topple.

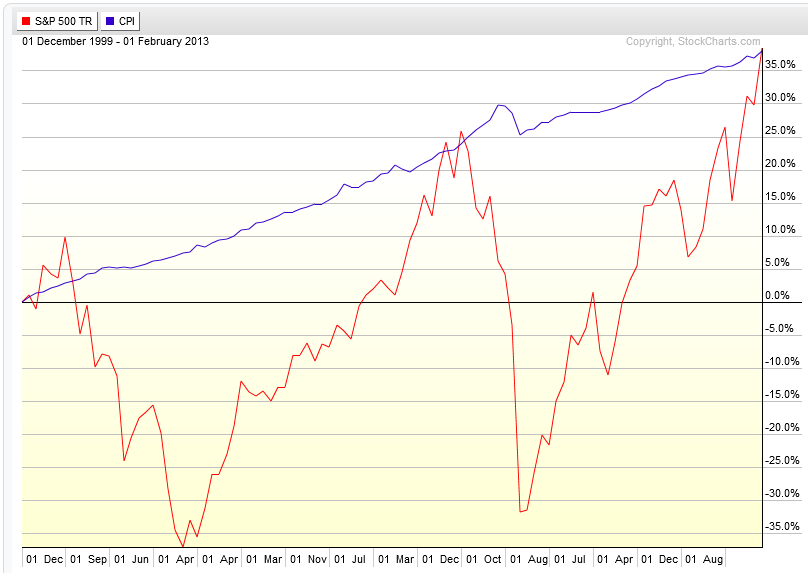

Of course, before the collapse of 2008, we had another stretch of nice steady returns. Unfortunately, those steady returns were precipitated by the collapse of 2000-01. The net result of these periods of steadiness interrupted by periods of panic is a long period of futility. From January 2000 – January 2013, when we account for the impact of inflation, the S&P 500 produced a total return of 0%.

The problem that Jesse Livermore opined on in 1923 is still with us. It’s always been with us. That comforting illusion of steady returns makes us vulnerable to half-truths and marketing slogans that appeal to that desire. An average return for the market over a period of a hundred years is twisted to imply that it has some relevance or predictive relationship to the much shorter period of your investing life. There is a massive amount of buy-in to this myth, despite mountains of contrary evidence. This is where the strategic investor has an edge.

The problem that Jesse Livermore opined on in 1923 is still with us. It’s always been with us. That comforting illusion of steady returns makes us vulnerable to half-truths and marketing slogans that appeal to that desire. An average return for the market over a period of a hundred years is twisted to imply that it has some relevance or predictive relationship to the much shorter period of your investing life. There is a massive amount of buy-in to this myth, despite mountains of contrary evidence. This is where the strategic investor has an edge.

The non-strategic investor, in hopes of capturing those elusive steady gains, looks at periods of flat returns or inactivity as the enemy. He believes that holding cash is unproductive and that to get steady returns it only makes sense to be steadily invested. The strategic investor understands that there is no profit in denying or fighting the unsteady, uneven nature of the market. It can’t be bent to our will or wished into compliance with our schedule. The strategic investor goes the other way.

Embrace unsteadiness. Periods of small gains or small losses are OK. Treading water during times of upheaval is fine. Preserving capital when the odds are against you puts you in a position to mash the accelerator when the odds are with you again. Not having to make up miles of previously lost ground puts you in a position to more quickly advance and set new highs. Be patient until it’s time to be impatient. Go slow to go fast.

After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made big money for me. It was always my sitting.

-Jesse Livermore

Related Posts:

Enjoy this post? Please subscribe now to be notified whenever a new article or free white paper is published.

Disclaimer: Past performance is not indicative of future returns. Information displayed is taken from sources believed to be reliable but cannot be guaranteed. All indices are unmanaged and investors cannot invest directly into an index. Ideas and opinions expressed in this article are the sole responsibility of Patrick Crook/PLC Asset Management and do not reflect any stated opinions of Commonwealth Financial Network, National Financial Services LLC or any other person or entity.