Originally published 12/05/2008

Originally published 12/05/2008

Today (12/05/08), in Zurich, there is a hedge fund conference in session. A gathering of scores of very smart investment minds against a backdrop of epic market turmoil is bound to produce some interesting quotes. I kind of like this one from the CEO of a hedge fund consultancy: In response to a question regarding how he would adjust risk management systems in light of recent events, he responded;

“What happened to hedge funds over the past few months was not statistically possible, so it is going to be difficult to adjust risk management models to reflect what has happened.”

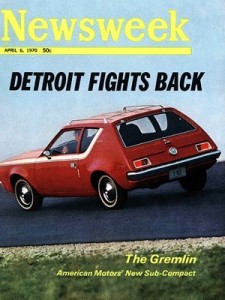

Reading between the lines, he is basically saying that the statistics, the data, the history, all of the information used by designers of risk management models to make assumptions about how their portfolios would act under stress proved to be useless. Attempting to adjust these broken models would be like painting a racing stripe on your ’73 Gremlin – pointless and self delusional. Rather than outsmarting the markets, these models ultimately turned on their masters. Or rather, they allowed their masters to turn on themselves. Lulled into a false sense of security, the wielders of these tools assumed too much risk and found themselves without an escape route when the markets came tumbling down.

Of course, it’s not just hedge funds. In The Folly of Certainty, I pointed out the dismal track record of a couple of the ‘Chief Risk Officers’ that every failed bank and financial services company seems to have been overpaying for years. They fell victim to the same false comfort of their own risk management models. Government has its own long history of problematic modeling. The City of Vallejo (California) recently filed for bankruptcy citing bloated obligations to retiring police and firefighters as the prime culprits. Undoubtedly, an army of consultants played an important role in contract negotiations that made these obligations look reasonable at the time they were agreed to. Auto company pension and health care benefits? Don’t worry, the models showed it all working out just fine. And The Banker has qualified for instant classic status with this headline from their January 8, 2007 issue; “Argentina looks to Fannie Mae model.” What could go wrong?

Although not nearly as intricate, most individual investors also use risk management models, in the guise of diversified portfolios. We try to mitigate risk by spreading our money across different types of assets that usually aren’t closely related to each other. By not putting all of our eggs in one basket, the total portfolio isn’t imperiled by a contraction in any single market. Or so we thought.

This time, all stocks – foreign & domestic, large & small have fallen together. Real estate markets are in shambles. Commodity prices have plummeted. Corporate bonds have taken a beating. The lesson on display is one of the most important concepts of risk. Consequences matter more than probability.

Even though history told us that it was very unlikely that all of these markets would simultaneously be so soundly thrashed, it happened. That the events of the past year were “statistically impossible” is of little solace to someone that has just seen 40% of their life savings disappear. So now that we have become keenly aware of the limitations of the standard, long-only, asset allocation model, how do investors protect themselves from events that fall outside the range of the predictable?

Active risk management. A strategy that acts as a second line of defense in an effort to limit the amount of loss that can be suffered by any single component of a portfolio. This can be accomplished in a number of ways: market or individual security risk can be hedged with a variety of derivative securities. Trailing stops can be set on publicly traded positions. A simple moving average crossover system or some other type of technical indicator can serve as a trigger point to reduce or eliminate exposure to a particular asset class. The most suitable strategy depends on a number of variables; the bigger point is that investors cannot afford to ignore the possibility of those infrequent events that can have calamitous, permanent consequences. You can’t eliminate all risk without eliminating the possibility of growth, but you may be able to protect a portfolio from substantial loss while still preserving your unlimited upside potential. Asymmetric returns should be the goal.

It’s interesting that we routinely hedge the financial risk of our house burning down, or the cost of treating an unusual illness or injury, or damages incurred by someone that might slip and fall on our doorstep. Yet very few investors hedge the far more likely risk of financial impairment due to a market decline. Even, as it often does, when the value of an investment portfolio exceeds the combined value of every other asset, developing a plan to actively manage risk is not a standard practice among individual investors. Managing portfolio risk is more complicated than buying an insurance policy, but it’s not rocket science.

In the last article, I posted Darwin’s famous quote about how the most successful species weren’t necessarily the strongest or most intelligent, but those most able to adapt to change. In this case, it’s not market risk that has changed, but the tools at our disposal to help manage it. They have never been more plentiful, accessible or as efficiently priced. Regardless of age or risk tolerance, limiting losses is a key to generating consistently good returns.

Of course, it would be easier not to worry about it. Really, what are the odds of something like this happening again?